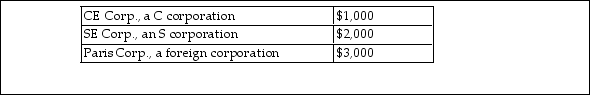

Natasha is a single taxpayer with $100,000 of taxable income. Included in the taxable income is distributions of e this year as follows:  How much of the $6,000 distribution will be taxed at the 15% tax rate?

How much of the $6,000 distribution will be taxed at the 15% tax rate?

A) $0

B) $1,000

C) $6,000

D) $3,000

Correct Answer:

Verified

Q74: Income from illegal activities is taxable.

Q79: Unemployment compensation is exempt from federal income

Q842: Jing, who is single, paid educational expenses

Q843: Tarik, a single taxpayer, has AGI of

Q844: In December of this year, Jake and

Q845: Amy's employer provides her with several fringe

Q847: Carla redeemed EE bonds which qualify for

Q848: Which of the following is not included

Q849: Derek, a single taxpayer, has AGI of

Q850: Distributions from corporations to the shareholders in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents