Under the terms of their divorce agreement executed in August of this year, Clint transferred Beta, Inc. stock to his former wife, Rosa, as a property settlement. At the time of the transfer, the stock had a basis to Clint of $55,000 and a fair market value of $68,000. Rosa subsequently sold the stock for $75,000. What is the tax consequence of first the stock transfer and then the stock sale to Rosa?

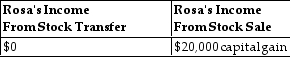

A)

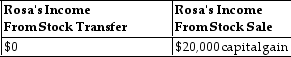

B)

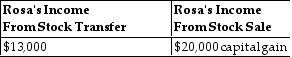

C)

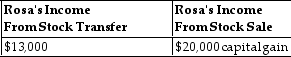

D)

Correct Answer:

Verified

Q862: Carolyn, who earns $400,000, is required to

Q863: Under the terms of their divorce agreement,

Q864: Thomas purchased an annuity for $20,000 that

Q865: Eva and Lisa each retired this year

Q866: Mark purchased 2,000 shares of Darcy Corporation

Q868: Natasha, age 58, purchases an annuity for

Q869: As a result of a divorce agreement

Q870: Julia, age 57, purchases an annuity for

Q871: With respect to property settlements in a

Q872: Which of the following is least likely

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents