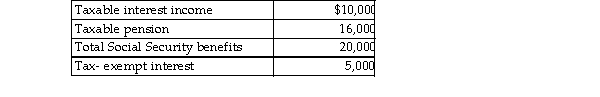

Mr. & Mrs. Tsayong are both over 66 years of age and are filing a joint return. Their income this year consisted of following:  They did not have any adjustments to income. What amount of Mr. & Mrs. Tsayongs Social Security benefits is t this year?

They did not have any adjustments to income. What amount of Mr. & Mrs. Tsayongs Social Security benefits is t this year?

A) $4,500

B) $10,000

C) $20,000

D) $0

Correct Answer:

Verified

Q10: Although exclusions are usually not reported on

Q895: During 2017, Mark's employer withheld $2,000 from

Q896: Sheryl is a single taxpayer with a

Q897: During 2017, Christiana's employer withheld $1,500 from

Q898: The term "Social Security benefits" does not

Q899: An electrician completes a rewiring job and

Q902: Gwen's marginal tax bracket is 24%. Under

Q903: Gabby is planning a divorce, the terms

Q904: Billy, age 10, found an old baseball

Q905: Betty is a single retiree who receives

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents