Ezinne transfers land with an adjusted basis of $50,000 and a FMV of $95,000 to a new business in exchange for a 50% ownership interest. The land is subject to a $60,000 mortgage which the business will assume. The business has no other liabilities outstanding. Indicate the amount of gain recognized by Ezinne due to this exchange if the building is transferred to (1) a corporation and (2) a partnership. Assume Sec. 351 is satisfied in the case of the corporation and Sec. 721 is satisfied in the case of the partnership.

A)

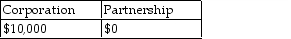

B)

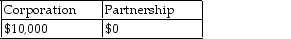

C)

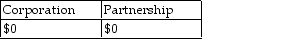

D)

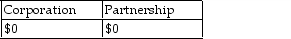

Correct Answer:

Verified

Q87: Joy is a material participant in a

Q1175: George transferred land having a $170,000 FMV

Q1176: Kuda exchanges property with a FMV of

Q1177: Martha transferred property with a FMV of

Q1178: Patrick acquired a 50% interest in a

Q1179: On April 5, 2018, Joan contributes business

Q1181: A taxpayer has various businesses which operate

Q1182: Sandy and Larry each have a 50%

Q1183: Richard has a 50% interest in a

Q1185: David and Joycelyn form an equal partnership

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents