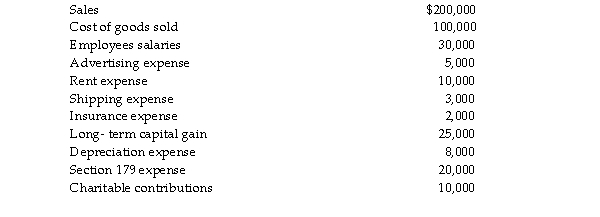

Longhorn Partnership reports the following items at the end of the current year:  What is the partnership's ordinary income? Which items are separately stated?

What is the partnership's ordinary income? Which items are separately stated?

Correct Answer:

Verified

Q1201: All of the following statements are true

Q1202: Ben is a 30% partner in a

Q1203: Elise contributes property having a $60,000 FMV

Q1204: XZ Partnership has two equal partners. Assume

Q1205: DAD Partnership has one corporate partner, Domino

Q1207: Which of the following statements regarding the

Q1208: Oliver receives a nonliquidating distribution of land

Q1209: Marlena contributes property having a $30,000 FMV

Q1210: At the beginning of this year, Thomas

Q1211: Brittany receives a nonliquidating distribution of $48,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents