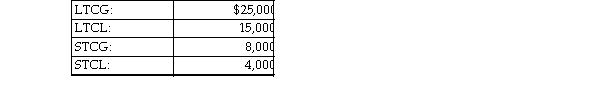

A corporation has the following capital gains and losses during the current year:  The tax result to the corporation is

The tax result to the corporation is

A) $10,000 NLTCG included in gross income and taxed at the ordinary rate; $4,000 NSTCG included in gross income and taxed at reduced rates.

B) $10,000 NLTCG is included in gross income and taxed at reduced rates; and $4,000 NSTCG included in gross income and taxed at the ordinary rate.

C) $14,000 included in gross income and taxed at reduced rates.

D) $14,000 included in gross income and taxed at the ordinary rate.

Correct Answer:

Verified

Q6: If a corporation receives dividends from an

Q15: If a corporation owns less than 20%

Q16: A corporation realizes a NSTCL this year

Q18: For corporations,NSTCLs and NLTCLs are treated as

Q38: Accrual-basis corporations may accrue a charitable contribution

Q132: Eva is the sole shareholder of an

Q1278: Minna is a 50% owner of a

Q1279: The partnership will make all of the

Q1285: A corporation incurs a net operating loss

Q1288: All of the following business forms offer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents