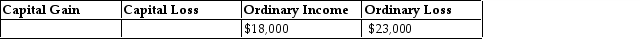

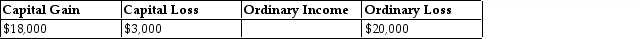

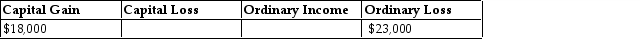

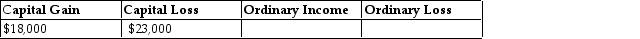

Jeremy has $18,000 of Sec. 1231 gains and $23,000 of Sec. 1231 losses. The gains and losses are characterized as

A)

B)

C)

D)

Correct Answer:

Verified

Q7: Mark owns an unincorporated business and has

Q121: A couple has filed a joint tax

Q1665: Blair, whose tax rate is 24%, sells

Q1666: Discuss actions a taxpayer can take if

Q1668: Pierce has a $16,000 Sec. 1231 loss,

Q1669: Form 6251, Alternative Minimum Tax, must be

Q1672: Jillian, a single taxpayer, had the following

Q1673: Jaiyoun sells Sec. 1231 property this year,

Q1674: Lucy, a noncorporate taxpayer, experienced the following

Q1675: During the current year, Kayla recognizes a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents