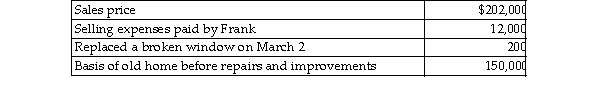

Frank, a single person, sold his home this year. He had owned and lived in the house for 10 years. Frank signed contract on March 4 to sell his home and closed the sale on May 3.  Based on these facts, what is the amount of his recognized gain?

Based on these facts, what is the amount of his recognized gain?

A) $52,000

B) $39,800

C) $40,000

D) $0

Correct Answer:

Verified

Q66: If a taxpayer owns more than one

Q67: In order for the gain on the

Q73: The taxpayer must be occupying the residence

Q1858: Ron's building, which was used in his

Q1859: The building used in Terry's business was

Q1860: Alex owns an office building which the

Q1862: Mick owns a racehorse with a $500,000

Q1865: According to Sec. 121, individuals who sell

Q1866: William and Kate married in 2018 and

Q1867: Bob and Elizabeth Brown, a married couple,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents