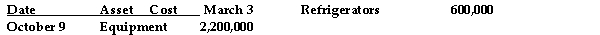

During the year 2018, a calendar- year taxpayer, Marvelous Munchies, a chain of specialty food shops, purchased equipment as follows:  Assume the property is all 5- year property. What is the maximum depreciation that may be deducted for the assets this year, 2018, assuming Sec. 179 expensing and bonus depreciation are not claimed?

Assume the property is all 5- year property. What is the maximum depreciation that may be deducted for the assets this year, 2018, assuming Sec. 179 expensing and bonus depreciation are not claimed?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2090: If the business usage of listed property

Q2091: All of the following are true with

Q2092: Enrico is a self- employed electrician. In

Q2093: In August 2018, Tianshu acquires and places

Q2094: Jack purchases land which he plans on

Q2096: Arthur uses a Chevrolet Suburban (GVWR 7,500

Q2097: Everest Corp. acquires a machine (seven- year

Q2098: In February 2018, Pietra acquired a new

Q2099: Greta, a calendar- year taxpayer, acquires 5-

Q2100: In the current year George, a college

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents