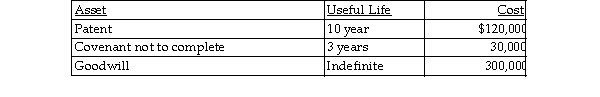

Stellar Corporation purchased all of the assets of Bellavia Company as of January 1 this year for $1 million. Included in the assets acquired are the following intangible assets:  What is Stellar's maximum amortization deduction for the year?

What is Stellar's maximum amortization deduction for the year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q67: Unless an election is made to expense

Q69: Taxpayers are entitled to a depletion deduction

Q72: Off-the-shelf computer software that is purchased for

Q79: If a company acquires goodwill in connection

Q2111: This year Bauer Corporation incurs the following

Q2113: Bert, a self- employed attorney, is considering

Q2114: Costs that qualify as research and experimental

Q2117: Jimmy acquires an oil and gas property

Q2118: In accounting for research and experimental expenditures

Q2119: Why would a taxpayer elect to capitalize

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents