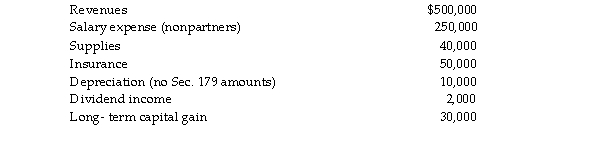

AT Pet Spa is a partnership owned equally by Travis and Ashley. The partnership had the following revenues an expenses this year. Which of the following items are separately stated? Nonseparately stated? What is each partn distributive share of ordinary income?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q31: Karl arranges financing for a limited partnership

Q38: Jane contributes land with an FMV of

Q40: Bao had investment land that he purchased

Q41: What are the three rules and their

Q44: In computing the ordinary income of a

Q46: Identify which of the following statements is

Q46: A partnership cannot make charitable contributions.

Q49: Does the contribution of services to a

Q49: Identify which of the following statements is

Q56: Charles Jordan files his income tax return

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents