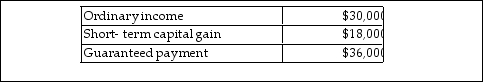

Brent is a general partner in BC Partnership. His distributive share of partnership income and his guaranteed payment for the year are as follows:  What is his self- employment income?

What is his self- employment income?

A) $36,000

B) $48,000

C) $66,000

D) $84,000

Correct Answer:

Verified

Q104: Yee manages Huang real estate, a partnership

Q104: In January of this year, Arkeva, a

Q105: Identify which of the following statements is

Q105: A partnership must file Form 1065 only

Q107: Janice has a 30% interest in the

Q108: When determining the guaranteed payment, which of

Q110: Bud has devoted his life to his

Q110: Yee manages Huang real estate, a partnership

Q113: Henry has a 30% interest in the

Q114: In January, Daryl and Louis form a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents