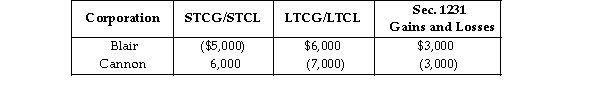

Blair and Cannon Corporations are members of an affiliated group. No prior net Sec. 1231 losses have been reported by any group member. The two corporations report consolidated ordinary income of $100,000 and gains and losses from property transactions as follows.  Which of the following statements is correct?

Which of the following statements is correct?

A) The consolidated group reports a net short- term capital gain of $1,000.

B) Cannon Corporation's separate return reports a $1,000 net long- term capital loss.

C) Blair Corporation's separate return reports a $4,000 net long- term capital gain.

D) All three of the above are correct.

Correct Answer:

Verified

Q46: The treatment of capital loss carrybacks and

Q48: What are the five steps in calculating

Q51: Identify which of the following statements is

Q55: Boxcar Corporation and Sidecar Corporation, an affiliated

Q58: Parent Corporation purchases a machine (a five-

Q59: Which of the following statements is true?

A)

Q60: The Alpha- Beta affiliated group has consolidated

Q63: Blue and Gold Corporations are members of

Q72: Jason and Jon Corporations are members of

Q77: Mariano owns all of Alpha Corporation, which

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents