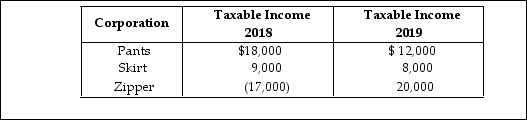

Pants and Skirt Corporations are affiliated and have filed consolidated tax returns for the past three years. Pants acquires 100% of Zipper stock on January 1 of 2019. Zipper Corporation filed separate returns previously. Pants, Skirt, and Zipper filed a consolidated return for 2019 and reported the following taxable incomes:  How much of the 2018 Zipper NOL be used to offset CTI in 2019?

How much of the 2018 Zipper NOL be used to offset CTI in 2019?

A) $0

B) $17,000

C) $20,000

D) $16,000

Correct Answer:

Verified

Q48: What are the five steps in calculating

Q61: Parent and Subsidiary Corporations are members of

Q63: Blue and Gold Corporations are members of

Q64: P and S comprise an affiliated group

Q67: Parent and Subsidiary Corporations form an affiliated

Q70: Key and Glass Corporations were organized in

Q72: Jason and Jon Corporations are members of

Q72: Jackson and Tanker Corporations are members of

Q77: Mariano owns all of Alpha Corporation, which

Q88: Blitzer Corporation is the parent corporation of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents