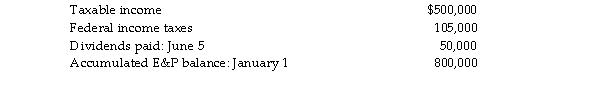

Lawrence Corporation reports the following results during the current year:  No dividends were paid in the throwback period. A long- term capital gain of $50,000 is included in taxable inco The statutory accumulated earnings tax exemption has been used up in prior years. An additional earnings accumulation of $60,000 for the current year can be justified as meeting the reasonable needs of the business.

No dividends were paid in the throwback period. A long- term capital gain of $50,000 is included in taxable inco The statutory accumulated earnings tax exemption has been used up in prior years. An additional earnings accumulation of $60,000 for the current year can be justified as meeting the reasonable needs of the business.

What is Lawrence Corporation's accumulated earnings tax liability?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q42: When computing the accumulated earnings tax, the

Q42: The courts and the Treasury Regulations have

Q45: Eight individuals own Navy Corporation, a C

Q45: Which of the following actions cannot be

Q51: In determining accumulated taxable income for the

Q52: Identify which of the following statements is

Q54: The following information is reported by Acme

Q55: The accumulated earnings tax is imposed at

Q56: A manufacturing corporation has accumulated E&P of

Q57: A corporation cannot reasonably accumulate earnings to

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents