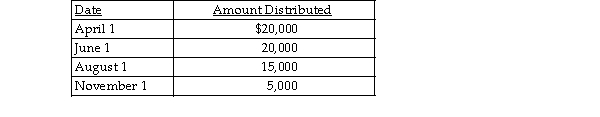

Exit Corporation has accumulated E&P of $24,000 at the beginning of the current tax year. Current E&P is $20,000. During the year, the corporation makes the following distributions to its sole shareholder who has a $22,000 basis for her stock.  The treatment of the $15,000 August 1 distribution would be

The treatment of the $15,000 August 1 distribution would be

A) $15,000 is taxable as a dividend; $5,000 from current E&P and the balance from accumulated E&P.

B) $4,000 is taxable as a dividend from accumulated E&P, and $11,000 is tax- free as a return of capital.

C) $15,000 is taxable as a dividend from accumulated E&P.

D) $5,000 is taxable as a dividend from current E&P, and $10,000 is tax- free as a return of capital.

Correct Answer:

Verified

Q1: Grant Corporation sells land (a noninventory item)

Q2: Corporate distributions that exceed earnings and profits

Q3: Identify which of the following increases Earnings

Q6: Current E&P does not include

A) federal income

Q7: In 2010, Tru Corporation deducted $5,000 of

Q9: In the current year, Ho Corporation sells

Q14: For purposes of determining current E&P, which

Q15: Tomika Corporation has current and accumulated earnings

Q18: Poppy Corporation was formed three years ago.

Q35: Outline the computation of current E&P, including

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents