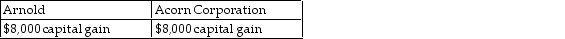

Perch Corporation has made paint and paint brushes for the past ten years. Perch Corporation is owned equally by Arnold, an individual, and Acorn Corporation. Perch Corporation has $100,000 of accumulated and current E&P. Both Arnold and Acorn Corporation have a basis in their stock of $10,000. Perch Corporation discontinues the paint brush operation and distributes assets worth

$10,000 each to Arnold and Acorn Corporation in redemption of 20% of their stock. Due to the distribution, Arnold and Acorn Corporation must report:

A)

B)

C)

D)

Correct Answer:

Verified

Q61: Which of the following requirements must be

Q62: Elijah owns 20% of Park Corporation's single

Q70: Ace Corporation has a single class of

Q75: Which of the following is not a

Q76: Why are stock dividends generally nontaxable? Under

Q82: Maury Corporation has 200 shares of stock

Q87: Dave, Erica, and Faye are all unrelated.

Q92: All of Sphere Corporation's single class of

Q95: Peter owns all 100 shares of Parker

Q99: Define Sec. 306 stock.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents