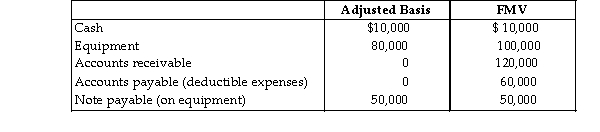

Martin operates a law practice as a sole proprietorship using the cash method of accounting. Martin incorporates the law practice and transfers the following items to a new, solely owned corporation.  Martin must recognize a gain of and has a stock basis of :

Martin must recognize a gain of and has a stock basis of :

A) $20,000; $40,000

B) $20,000; $30,000

C) $0; $40,000

D) $0; $30,000

Correct Answer:

Verified

Q64: Chris transfers land with a basis of

Q66: Maria has been operating a business as

Q66: Silvia transfers to Leaf Corporation a machine

Q67: The transferor's holding period for any boot

Q68: The transferee corporation's basis in property received

Q69: Mario and Lupita form a corporation in

Q70: A medical doctor incorporates her medical practice,

Q71: Colleen operates a business as a sole

Q79: Identify which of the following statements is

Q80: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents