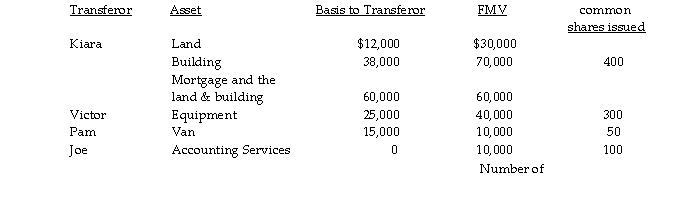

On May 1 of the current year, Kiara, Victor, Pam, and Joe form Newco Corporation with the following investme

Property Transferred  Kiara purchased the land and building several years ago for $12,000 and $50,000, respectively. Kiara has claimed straight- line depreciation on the building. Victor also received a Newco Corporation note for $10,000 due in thre The note bears interest at a rate acceptable to the IRS. Victor purchased the equipment three years ago for $50,00 also receives $5,000 cash. Pam purchased the van two years ago for $20,000.

Kiara purchased the land and building several years ago for $12,000 and $50,000, respectively. Kiara has claimed straight- line depreciation on the building. Victor also received a Newco Corporation note for $10,000 due in thre The note bears interest at a rate acceptable to the IRS. Victor purchased the equipment three years ago for $50,00 also receives $5,000 cash. Pam purchased the van two years ago for $20,000.

a) Does the transaction satisfy the requirements of Sec. 351?

b) What are the amounts and character of the reorganized gains or losses to Kiara, Victor, Pam, Joe, and Newco Corporation?

c) What is each shareholder's basis for his or her Newco stock? When does the holding period for the stock beg

d) What is Newco Corporation's basis for its property and services? When does its holding period begin for eac property?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q85: Dan transfers property with an adjusted basis

Q88: Anton, Bettina, and Caleb form Cage Corporation.

Q90: Lynn transfers property with a $56,000 adjusted

Q91: South Corporation acquires 100 shares of treasury

Q92: Abby owns all 100 shares of Rent

Q93: Reba, a cash basis accountant, transfers all

Q95: On July 9, 2008, Tom purchased a

Q96: Discuss the impact of the contribution of

Q98: Norman transfers machinery that has a $45,000

Q99: Zoe Ann transfers machinery having a $36,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents