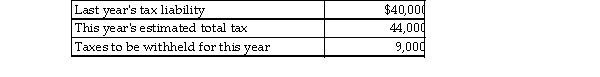

Your client wants to avoid any penalty for underpayment of estimated taxes by making timely deposits. Determine the amount of the minimum quarterly estimated tax payments required to avoi the penalty. Assume your client's adjusted gross income last year was $140,000.

A) $8,750

B) $7,650

C) $7,750

D) $11,000

Correct Answer:

Verified

Q22: Which one of the following statements about

Q28: The "automatic" extension period for filing an

Q41: A substantial understatement of tax liability involves

Q44: On August 13 of the following year,

Q48: Paul's tax liability for last year was

Q49: A $500 penalty for each instance of

Q50: If Brad files his last year's individual

Q54: Jeff's tax liability for last year was

Q55: A taxpayer can automatically escape the penalty

Q59: On July 25 of the following year,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents