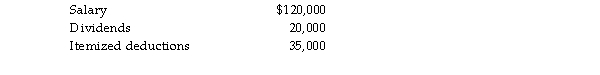

Latka Novatny gave you the following information to use in the preparation of his current year's tax return:  In addition, he received $40,000 from a relative for whom he had worked previously. You have researched whet

In addition, he received $40,000 from a relative for whom he had worked previously. You have researched whet

$40,000 should be classified as a gift or compensation and are confident that substantial authority exists for classi as a gift. What tax compliance issues should you consider in deciding whether to report or exclude the $40,000?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q61: Identify which of the following statements is

Q63: The IRS audited the tax returns of

Q64: The statute of limitations is unlimited for

Q71: Linda's individual tax return for the current

Q75: A six- year statute of limitation rule

Q76: You are preparing the tax return for

Q79: Identify which of the following statements is

Q88: The "Statement on Practice in the Field

Q89: According to Circular 230, what should a

Q96: All of the following requirements must be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents