The Williams Trust was established six years ago. The trust document allows the trustee to distribute income in i discretion to beneficiaries Carol and Karen for the next 15 years. The trust will then be terminated and the trust a will be divided equally between Carol and Karen. Capital gains are part of principal.

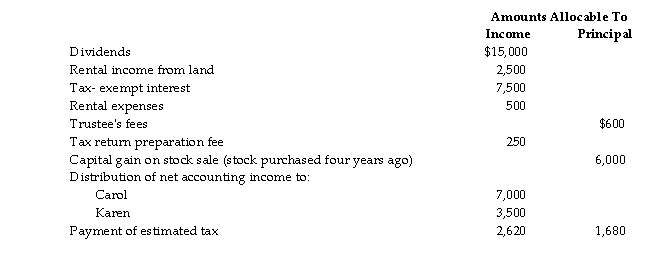

The current year income and expenses of the trust are reported below.  Compute (a) distributable net income (DNI), (b) distribution deduction, (c) trust taxable income, and (d) Carol's a Karen's reportable income and its classification. Charge all of the deductible expenses against the rental income.

Compute (a) distributable net income (DNI), (b) distribution deduction, (c) trust taxable income, and (d) Carol's a Karen's reportable income and its classification. Charge all of the deductible expenses against the rental income.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q63: Apple Trust reports net accounting income of

Q68: Identify which of the following statements is

Q71: Martha died and by her will, specifically

Q72: The Tucker Trust was established six years

Q73: Identify which of the following statements is

Q77: A trust has net accounting income and

Q78: Apple Trust reports net accounting income of

Q86: Income in respect of a decedent (IRD)is

Q94: Income in respect of a decedent (IRD)includes

Q99: An example of income in respect to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents