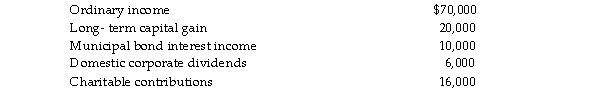

Rocky Corporation, an S corporation, reports the following results for the current year:  Rocky's AAA and accumulated E&P balances at the beginning of the year are $80,000 and $50,000, respectively. makes a $100,000 cash distribution to its sole shareholder on June 1 and a second $100,000 cash distribution on D

Rocky's AAA and accumulated E&P balances at the beginning of the year are $80,000 and $50,000, respectively. makes a $100,000 cash distribution to its sole shareholder on June 1 and a second $100,000 cash distribution on D

1. The shareholder's basis for Rocky stock on January 1 was $120,000. Discuss the tax consequences of these transactions.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: Jeff owns 50% of an S corporation's

Q84: An S corporation is not treated as

Q85: An electing S corporation has a $30,000

Q90: Caravan Corporation has always been an S

Q90: Identify which of the following statements is

Q97: Identify which of the following statements is

Q99: David owns 25% of an S corporation's

Q101: Mashburn Corporation is an S corporation that

Q101: Which of the following tax levies imposed

Q102: An S corporation is permitted an automatic

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents