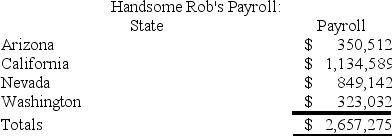

Handsome Rob provides transportation services in several western states.Rob has payroll as follows:  Rob is a California corporation and the following is true:

Rob is a California corporation and the following is true:

Rob has income tax nexus in Arizona,California,Nevada,and Washington.The Washington drivers spend 25 percent of their time driving through Oregon.California payroll includes $200,000 of payroll for services provided in Nevada by California-based drivers.What is Rob's California payroll numerator?

A) $934,589

B) $1,134,589

C) $1,215,347

D) $2,657,275

Correct Answer:

Verified

Q81: What was the Supreme Court's holding in

Q90: Lefty provides demolition services in several southern

Q96: Which of the following is not a

Q100: Which of the following is an income-based

Q100: Which of the following is not a

Q102: Gordon operates the Tennis Pro Shop in

Q109: List the steps necessary to determine an

Q111: Gordon operates the Tennis Pro Shop in

Q114: Mighty Manny, Incorporated manufactures and services deli

Q119: Super Sadie, Incorporated, manufactures sandals and distributes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents