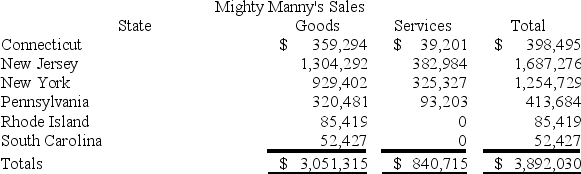

Mighty Manny,Incorporated,manufactures and services deli machinery and distributes it across the United States.Mighty Manny is incorporated and headquartered in New Jersey.It has sales tax nexus in Connecticut,New Jersey,New York,Pennsylvania,Rhode Island,and South Carolina.Mighty Manny has sales as follows:

Assume the following sales tax rates: Connecticut (6.75 percent),New Jersey (7.5 percent),New York (8.5 percent),Pennsylvania (6.5 percent),Rhode Island (7.25 percent),and South Carolina (5.5 percent).Assume that Connecticut also taxes Mighty Manny's services.What is Mighty Manny's total sales and use tax liability?

Assume the following sales tax rates: Connecticut (6.75 percent),New Jersey (7.5 percent),New York (8.5 percent),Pennsylvania (6.5 percent),Rhode Island (7.25 percent),and South Carolina (5.5 percent).Assume that Connecticut also taxes Mighty Manny's services.What is Mighty Manny's total sales and use tax liability?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: What was the Supreme Court's holding in

Q87: Which of the following is not a

Q90: Lefty provides demolition services in several southern

Q92: Which of the following is not a

Q93: Wacky Wendy produces gourmet cheese in Wisconsin.Wendy

Q94: Carolina's Hats has the following sales,payroll,and property

Q96: Discuss the steps necessary to determine whether

Q97: Della Corporation is headquartered in Carlisle, Pennsylvania.

Q98: Super Sadie,Incorporated,manufactures sandals and distributes them across

Q102: Gordon operates the Tennis Pro Shop in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents