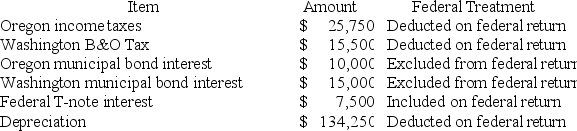

Moss Incorporated is a Washington corporation.It properly included,deducted,or excluded the following items on its federal tax return in the current year:

Moss's Oregon depreciation was $145,500.Moss's federal taxable income was $549,743.Calculate Moss's Oregon state tax base.

Moss's Oregon depreciation was $145,500.Moss's federal taxable income was $549,743.Calculate Moss's Oregon state tax base.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: Gordon operates the Tennis Pro Shop in

Q104: Gordon operates the Tennis Pro Shop in

Q104: Assume Tennis Pro discovered that one salesperson

Q107: Tennis Pro has the following sales,payroll,and property

Q108: Gordon operates the Tennis Pro Shop in

Q110: Gordon operates the Tennis Pro Shop in

Q114: Gordon operates the Tennis Pro Shop in

Q115: Tennis Pro has the following sales,payroll,and property

Q117: Gordon operates the Tennis Pro Shop in

Q124: Tennis Pro is headquartered in Virginia. Assume

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents