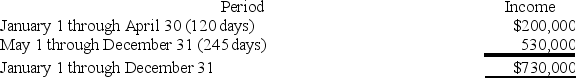

ABC was formed as a calendar-year S corporation with Alan,Brenda,and Conner as equal shareholders.On May 1,2019,ABC's S election was terminated after Conner sold his ABC shares (one-third of all shares)to his solely owned C corporation,Conner,Inc.ABC reported business income for 2019 as follows: (Assume that there are 365 days in the year.)

If ABC uses the daily method of allocating income between the S corporation short tax year (January 1-April 30)and the C corporation short tax year (May 1-December 31),how much income will it report on its S corporation short tax year return and its C corporation short tax year return for 2019?

If ABC uses the daily method of allocating income between the S corporation short tax year (January 1-April 30)and the C corporation short tax year (May 1-December 31),how much income will it report on its S corporation short tax year return and its C corporation short tax year return for 2019?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q101: Jackson is the sole owner of JJJ

Q105: ABC Corp.elected to be taxed as an

Q108: Which of the following statements is correct

Q108: CB Corporation was formed as a calendar-year

Q109: Parker is a 100 percent shareholder of

Q112: XYZ was formed as a calendar-year S

Q113: Maria, a resident of Mexico City, Mexico,

Q114: Jason is one of 100 shareholders in

Q116: Suppose SPA Corp.was formed by Sara Inc.(a

Q120: Shea is a 100 percent owner of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents