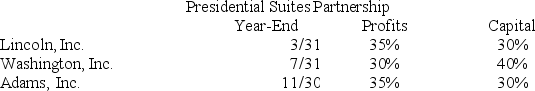

Lincoln,Inc.,Washington,Inc.,and Adams,Inc.,form Presidential Suites Partnership on February 15,20X9.Now,Presidential Suites must adopt its required tax year-end.The partners' year-ends,profits interests,and capital interests are reflected in the table below.Given this information,what tax year-end must Presidential Suites use,and what rule requires this year-end?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: On March 15, 20X9, Troy, Peter, and

Q88: In each of the independent scenarios below,

Q90: KBL,Inc.,AGW,Inc.,Blaster,Inc.,Shiny Shoes,Inc.,and a group of 24 individuals

Q91: At the end of Year 1,Tony had

Q95: Lloyd and Harry,equal partners,form the Ant World

Q97: Jordan,Inc.,Bird,Inc.,Ewing,Inc.,and Barkley,Inc.,formed Nothing-But-Net Partnership on June 1st,20X9.Now,Nothing-But-Net

Q98: On March 15, 20X9, Troy, Peter, and

Q98: Ruby's tax basis in her partnership interest

Q119: Why are guaranteed payments deducted in calculating

Q121: Explain why partners must increase their tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents