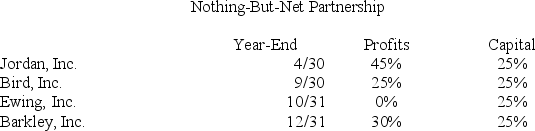

Jordan,Inc.,Bird,Inc.,Ewing,Inc.,and Barkley,Inc.,formed Nothing-But-Net Partnership on June 1st,20X9.Now,Nothing-But-Net must adopt its required tax year-end.The partners' year-ends,profits interests,and capital interests are reflected in the table below.Given this information,what tax year-end must Nothing-But-Net use,and what rule requires this year-end?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: On March 15, 20X9, Troy, Peter, and

Q88: In each of the independent scenarios below,

Q93: Lincoln,Inc.,Washington,Inc.,and Adams,Inc.,form Presidential Suites Partnership on February

Q95: Lloyd and Harry,equal partners,form the Ant World

Q98: Ruby's tax basis in her partnership interest

Q99: Illuminating Light Partnership had the following revenues,expenses,gains,losses,and

Q111: What general accounting methods may be used

Q119: Why are guaranteed payments deducted in calculating

Q122: Bob is a general partner in Fresh

Q123: What is the difference between a partner's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents