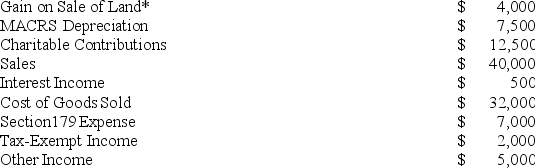

ER General Partnership,a medical supplies business,states in its partnership agreement that Erin and Ryan agree to split profits and losses according to a 40/60 ratio.Additionally,the partnership will provide Erin with a $15,000 guaranteed payment for services she provides to the partnership.ER Partnership reports the following revenues,expenses,gains,losses,and distributions for its current taxable year:

*The land is a Section 1231 asset.

*The land is a Section 1231 asset.

Given these items,answer the following questions:

A.Compute Erin's share of ordinary income (loss)and separately stated items.Include her self-employment income as a separately stated item.

B.Compute Erin's self-employment income,but assume ER Partnership is a limited partnership and Erin is a limited partner.

C.Compute Erin's self-employment income,but assume ER Partnership is an LLC and Erin is personally liable for half of the debt of the LLC.Apply the IRS's proposed regulations in formulating your answer.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q63: Which of the following statements regarding a

Q73: How does additional debt or relief of

Q81: Alfred,a one-third profits and capital partner in

Q86: On April 18, 20X8, Robert sold his

Q86: J&J,LLC,was in its third year of operations

Q94: On June 12, 20X9, Kevin, Chris, and

Q97: Which person would generally be treated as

Q103: Greg, a 40percent partner in GSS Partnership,

Q112: This year, Reggie's distributive share from Almonte

Q121: Explain why partners must increase their tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents