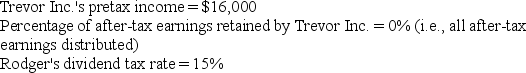

Rodger owns 100 percent of the shares in Trevor Inc.,a C corporation.Assume the following for the current year:

Given these assumptions,how much cash does Rodger have from the dividend after all taxes have been paid?

Given these assumptions,how much cash does Rodger have from the dividend after all taxes have been paid?

Correct Answer:

Verified

Q63: Jorge is a 100-percent owner of JJ

Q63: In 2019, BYC Corporation (a C corporation)had

Q64: P corporation owns 60 percent of the

Q64: In its first year of existence (2018),

Q66: Jorge is a 60-percent owner of JJ

Q68: If you were seeking an entity with

Q74: Which of the following statements is true

Q75: For which type of entity does the

Q76: What is the tax impact to a

Q79: The excess loss limitations apply to owners

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents