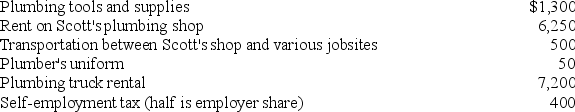

Scott is a self-employed plumber and his wife,Emily,is a full-time employee for a university.Emily has health insurance from a qualified plan provided by the university,but Scott has chosen to purchase his own health insurance rather than participate in Emily's plan.Besides paying $5,400 for his health insurance premiums,Scott also pays the following expenses associated with his plumbing business:

What is the amount of deductions for AGI that Scott can claim this year (2019)?

What is the amount of deductions for AGI that Scott can claim this year (2019)?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q53: Campbell, a single taxpayer, has $95,000 of

Q57: Opal fell on the ice and injured

Q58: Brice is a single,self-employed electrician who earns

Q60: Ned is a head of household with

Q61: Which of the following is a deductible

Q62: Glenn is an accountant who races stock

Q66: Andres and Lakeisha are married and file

Q68: Frieda is 67 years old and deaf.If

Q74: Which of the following is a true

Q97: This year Tiffanie files as a single

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents