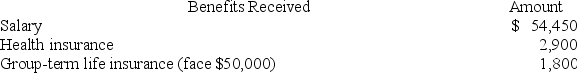

Frank received the following benefits from his employer this year.What amount must Frank include in his gross income?

A) $54,450

B) $57,350

C) $56,250

D) $59,150

E) $0-these benefits are excluded from gross income.

Correct Answer:

Verified

Q61: To calculate a gain or loss on

Q68: Emily is a cash-basis taxpayer, and she

Q71: Which of the following describes how the

Q73: Opal deducted $2,400 of state income taxes

Q76: George purchased a life annuity for $3,200

Q85: Mike received the following interest payments this

Q101: Shaun is a student who has received

Q109: Graham has accepted an offer to do

Q111: Irene's husband passed away this year. After

Q119: In January of the current year, Dora

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents