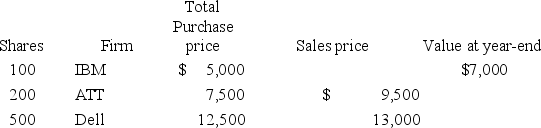

This year Ann has the following stock transactions.What amount is included in her gross income if Ann paid a $200 selling commission for each sale?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q121: Aubrey and Justin file married filing separately.

Q126: Desai and Lucy divorced in 2018. Lucy

Q129: Charles purchased an annuity from an insurance

Q130: Henry works part time on auto repairs

Q132: Kathryn is employed by Acme and they

Q135: Wendell is an executive with CFO Tires.

Q137: Aubrey and Justin file married filing separately.

Q146: This year Kelsi received a $1,900 refund

Q148: Lisa and Collin are married. Lisa works

Q151: Alex is 63 years old and retired.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents