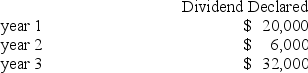

Fargo Company's outstanding stock consists of 400 shares of noncumulative 5% preferred stock with a $10 par value and 3,000 shares of common stock with a $1 par value.During the first three years of operation,the corporation declared and paid the following total cash dividends.  The amount of dividends paid to preferred and common shareholders in year 1 is:

The amount of dividends paid to preferred and common shareholders in year 1 is:

A) $200 preferred; $19,800 common.

B) $4,000 preferred; $16,000 common.

C) $17,000 preferred; $3,000 common.

D) $10,000 preferred; $10,000 common.

E) $20,000 preferred; $0 common.

Correct Answer:

Verified

Q142: Fetzer Company declared a $0.55 per share

Q145: West Company declared a $0.50 per share

Q148: Treasury stock is classified as:

A)An asset account.

B)A

Q155: Fetzer Company declared a $0.55 per share

Q166: The following data has been collected about

Q167: Prior to June 30,a company has never

Q169: All of the following regarding accounting for

Q174: The following data has been collected about

Q175: Prior to September 30,a company has never

Q176: Prior to May 1,Fortune Company has never

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents