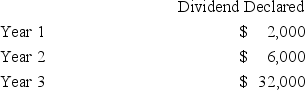

Sweet Company's outstanding stock consists of 1,000 shares of cumulative 5% preferred stock with a $100 par value and 5,000 shares of common stock with a $10 par value.During the first three years of operation,the corporation declared and paid the following total cash dividends.  The total amount of dividends paid to preferred and common shareholders over the three-year period is:

The total amount of dividends paid to preferred and common shareholders over the three-year period is:

A) $15,000 preferred; $25,000 common.

B) $11,000 preferred; $29,000 common.

C) $5,000 preferred; $35,000 common.

D) $12,000 preferred; $28,000 common.

E) $10,000 preferred; $30,000 common.

Correct Answer:

Verified

Q147: Prior to June 30,a company has never

Q174: Explain how to compute dividend yield and

Q180: What is a corporation? Identify the key

Q183: What is treasury stock? What reasons might

Q183: Explain where each of the following items

Q184: Halverstein Company's outstanding stock consists of 7,000

Q190: A corporation received its charter and began

Q191: Explain the difference between a large stock

Q193: A corporation issued 5,000 shares of its

Q195: What is a stock split? How is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents