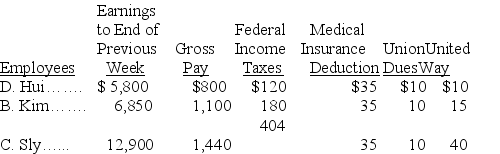

The payroll records of a company provided the following data for the current weekly pay period ended March 12.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $127,200 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Calculate the net pay for each employee.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $127,200 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Calculate the net pay for each employee.

Correct Answer:

Verified

Q127: General Co.entered into the following transactions involving

Q129: Star Recreation receives $48,000 cash in advance

Q188: Obligations due within one year or the

Q190: A company's payroll information for the month

Q191: Deacon Company provides you with following information

Q193: Richardson Fields receives $31,680 cash in advance

Q196: A _ shows the pay period dates,

Q197: _are amounts received in advance from

Q199: Banks authorized to accept deposits of amounts

Q200: _ are amounts owed to suppliers for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents