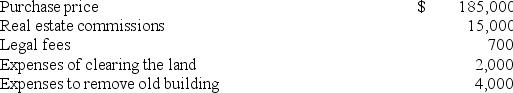

Merchant Company purchased property for a building site.The costs associated with the property were:  What portion of these costs should be allocated to the cost of the land and what portion should be allocated to the cost of the new building?

What portion of these costs should be allocated to the cost of the land and what portion should be allocated to the cost of the new building?

A) $187,700 to Land; $19,000 to Building.

B) $200,700 to Land; $6,000 to Building.

C) $200,000 to Land; $6,700 to Building.

D) $185,000 to Land; $21,700 to Building.

E) $206,700 to Land; $0 to Building.

Correct Answer:

Verified

Q21: Marlow Company purchased a point of sale

Q22: The depreciation method that produces larger depreciation

Q24: A company purchased property for $100,000.The property

Q28: Marlow Company purchased a point of sale

Q44: Revenue expenditures:

A)Are additional costs of plant assets

Q52: Marlow Company purchased a point of sale

Q59: Marks Consulting purchased equipment costing $45,000 on

Q93: Another name for a capital expenditure is:

A)

Q117: Fields Company purchased equipment on January 1

Q119: Fields Company purchased equipment on January 1

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents