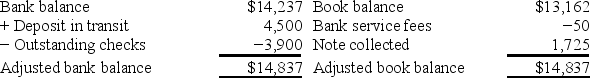

Franklin Company's bank reconciliation as of August 31 is shown below.  The adjusting journal entries that Clayborn must record as a result of the bank reconciliation include:

The adjusting journal entries that Clayborn must record as a result of the bank reconciliation include:

A) Debit Cash $4,500; credit Sales $4,500.

B) Debit Cash $1,725; credit Notes Receivable $1,725.

C) Debit Cash $50; credit Bank Service Fee Expense $50.

D) Debit Misc.Expense $3,900; credit Cash $3,900.

E) Debit Notes Receivable $1,725; credit Cash $1,725.

Correct Answer:

Verified

Q81: Havermill Co.establishes a $250 petty cash fund

Q98: Havermill Co.establishes a $250 petty cash fund

Q141: List the principles of internal control.

Q153: Clayborn Company deposits all cash receipts on

Q154: What is the purpose of the days'

Q156: Meng Co.maintains a $300 petty cash fund.On

Q157: Define an internal control system and describe

Q160: Ryan Company deposits all cash receipts on

Q161: A company established a petty cash fund

Q163: The treasurer of a company is responsible

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents