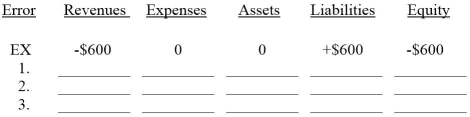

Given the table below,indicate the impact of the following errors made during the adjusting entry process.Use a "+" followed by the amount for overstatements,a "-" followed by the amount for understatements,and a "0" for no effect.The first one is done as an example.

Ex.Failed to recognize that $600 of unearned revenues,previously recorded as liabilities,had been earned by year-end.

1.Failed to accrue interest expense of $200.

2.Forgot to record $7,700 of depreciation on machinery.

3.Failed to accrue $1,300 of revenue earned but not collected.

Correct Answer:

Verified

Q137: Record the December 31 adjusting entries for

Q201: Andrew's net income was $280,000; its total

Q202: Glisten Co. leases an office to a

Q207: A company's employees earn a total of

Q349: Trapper Company's unadjusted and adjusted trial balances

Q350: Juno Company had $500 of office supplies

Q353: The following information is available for Hatter

Q355: The following unadjusted and adjusted trial balances

Q357: Based on the unadjusted trial balance for

Q358: Using the table below,indicate the impact of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents