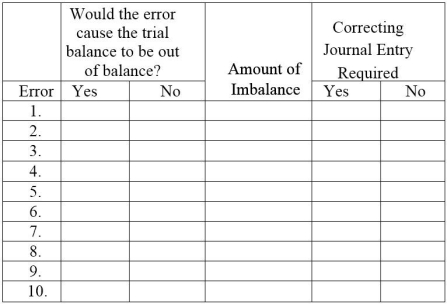

At year-end,Henry Laundry Service noted the following errors in its trial balance:

1.It understated the total debits to the Cash account by $500 when computing the account balance.

2.A credit sale for $311 was recorded as a credit to the revenue account,but the offsetting debit was not posted.

3.A cash payment to a creditor for $2,600 was never recorded.

4.The $680 balance of the Prepaid Insurance account was listed in the credit column of the trial balance.

5.A $24,900 van purchase was recorded as a $24,090 debit to Equipment and a $24,090 credit to Notes Payable.

6.A purchase of office supplies for $150 was recorded as a debit to Office Equipment.The offsetting credit entry was correct.

7.An additional investment of $4,000 by the stockholder was recorded as a debit to Common Stock and as a credit to Cash.

8.The cash payment of the $510 utility bill for December was recorded (but not paid)twice.

9.The revenue account balance of $79,817 was listed on the trial balance as $97,817.

10.A $1,000 cash dividend was recorded as a $100 debit to Dividends and $100 credit to Cash.

Using the form below,indicate whether each error would cause the trial balance to be out of balance,the amount of any imbalance,and whether a correcting journal entry is required.

Correct Answer:

Verified

Q205: Given each of the following errors,indicate on

Q207: For each of the following (1)identify

Q208: Jason Hope decided to open a hotel

Q209: After preparing an (unadjusted)trial balance at year-end,R.Chang

Q211: Larry Matt completed these transactions during December

Q213: For each of the following accounts,identify whether

Q214: The balances for the accounts of Milo's

Q215: Figgaro Company's accounts and their balances,as of

Q222: The second step in the analyzing and

Q234: The third step in the analyzing and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents