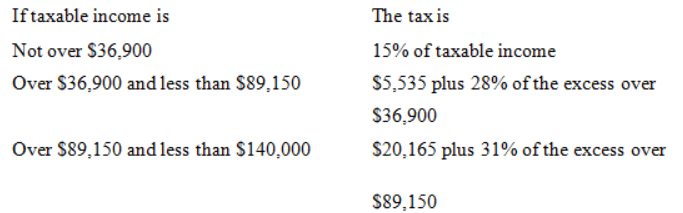

USE THE FOLLOWING TAX SCHEDULE TO ANSWER THE NEXT QUESTION.

-Amanda Huggins has an adjusted gross income of $45,500 and has itemized deductions and exemptions totaling $6,700. What is Ms. Huggins' marginal tax rate?

A) 13.3%

B) 15.0%

C) 15.6%

D) 28.0%

E) 31.0%

Correct Answer:

Verified

Q17: USE THIS INFORMATION FOR THE NEXT THREE

Q18: USE THIS INFORMATION FOR THE NEXT THREE

Q19: Under the current federal individual income tax

Q20: Tax credits, exemption, and exclusions all can

Q21: The present federal income tax structure would:

A)

Q22: On an accrual basis, my capital gain

Q23: The federal government may levy an individual

Q25: On a realization basis, my capital gain

Q26: Indexation of individual income taxes is designed

Q27: Governments provide tax preferences in several different

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents