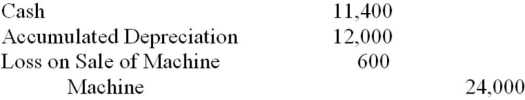

On April 1, 2014, Michal Company sold equipment for $11,400 cash. The equipment had originally been purchased at a cost of $24,000 on January 1, 2010. The equipment was expected to a useful life of 8 years with no residual value. As of January 1, 2014, had accumulated depreciation of $12,000. The entry to record the sale of the equipment was:

A)

B)

C)

D)

Correct Answer:

Verified

Q11: When a change in estimate is made,

Q57: Tangible assets include which of the following?

A)

Q58: In accounting for tangible operational assets, the

Q59: If a company classifies an expenditure as

Q60: Which of the following would most likely

Q61: What are operational assets that have physical

Q64: Foghorn Ltd. has an asset with an

Q65: On March 1, 20A, Jance Company purchased

Q67: The cost of a finite life intangible

Q114: Expenditures made after the asset is in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents