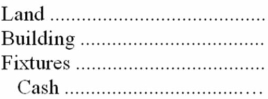

Yell Company made a lump sum purchase of an office building, including the land and some fixture

for cash of $160,000. The tax assessments for the past year reflected the following: Land, $22,500; Building, $58,500; and Fixtures, $9,000. Complete the following entry for the acquisition:

Correct Answer:

Verified

Q147: Pied Piper Pies has been in business

Q148: The following information is available for C

Q149: Tweed Feed & Seed purchased a new

Q150: Hilman Company purchased a truck on January

Q152: On September 7, 20B, Belverd Corporation purchased

Q153: Sutter Company purchased a machine on January

Q154: On January 2, 20D, Daintry Company purchased

Q155: Duval Company acquired a machine on January

Q156: Weaver Mining Company purchased a site containing

Q177: Rebuild Inc. purchased a plant and the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents