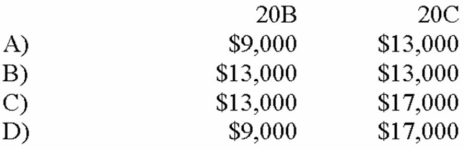

Wilder Company reported pretax profit amounts of: 20B, $11,000; and 20C, $15,000. Later it was discovered that the ending inventory for 20B was understated by $2,000 (and not corrected in 20C) . The correct pretax profit for each year was which of the following?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

Correct Answer:

Verified

Q7: In 20B, Landings Inc. provided the following

Q8: Which of the following is true?

A) Factory

Q9: Which of the following businesses would not

Q10: Two systems are used in accounting for

Q11: Joe Company sold merchandise with an invoice

Q13: If beginning inventory is understated by $1,300

Q14: When goods are sold on credit, revenue

Q15: The inventory turnover ratio is calculated by

Q16: David Company uses the gross method to

Q17: When a company uses the periodic inventory

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents