Landings Inc. provided the following footnote in their annual report:

Inventories are stated at the lower of cost or net realizable value. The cost of inventories has been determined using last in first out (FIFO) method. Cost of goods sold under FIFO costing were $22.2 billion for 20B and ending inventory under FIFO was $1.3 billion. Inventory in 20A under FIFO costing was $1.2 billion.

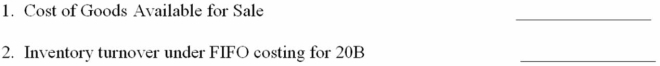

Compute the following for Landings:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: If prices never changed, there would be

Q97: When ending inventory is smaller than beginning

Q130: Goofy Company reported profit for 20A of

Q131: The Wilburn Company's income statement for 20B

Q132: Compute the missing amounts for the income

Q133: House Depot Company hired a new store

Q134: Assume World Company buys compact disks at

Q138: Supply the missing dollar amounts for the

Q139: All Sports Inc. manufactures sporting equipment and

Q140: Walker Corporation uses the periodic inventory method

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents