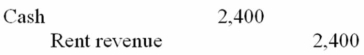

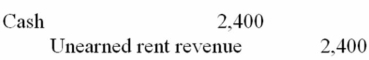

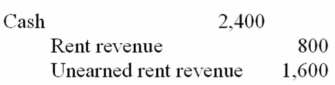

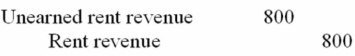

On September 1, 20A, RF Corporation collected rent of $2,400 for one year in advance. The three possible ways in which RF Corporation could have recorded the transaction on September 1, 20A, (i.e., the original journal entry) are listed below. Also listed are three different adjusting entries that could be made on December 31, 20A (the end of the accounting year). Match each journal entry with the appropriate adjusting entry.

Journal Entry, Sept. 1, 20A.

A.  B.

B.  C.

C.  Adjusting Entry, Dec 31, 20A

Adjusting Entry, Dec 31, 20A

1.  2.

2.  3. No adjusting entry needed

3. No adjusting entry needed

Correct Answer:

Verified

Q18: Prepaid expenses are costs that are paid

Q78: Match the following entry descriptions with the

Q79: Earnings per share (EPS) amounts must be

Q81: At the end of the accounting period,

Q84: Amortization attempts to adjust the value of

Q85: On July 1, 20A, Liz Company borrowed

Q86: To compute depreciation expense using the straight-line

Q106: External auditors closely examine the adjustment process

Q117: Amortization expense is an example of the

Q120: Analysts, investors, and creditors use these same

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents