Four transactions are given below that were completed during 20A by Lucky Company. The annual accounting period ends December 31. Each transaction will require an adjusting entry at December 31, 20A. Provide the adjusting entry required.

A. On January 1, 20A, Lucky Company purchased office equipment that cost $8,000. The estimated life of the office equipment was five years ($500 residual value).

December 31, 20A--Adjusting entry:

B. On June 1, 20A, Lucky Company paid $12,600 for one year's rent beginning on that date. The rent

payment was recorded as follows:

June 1, 20A:

December 31, 20A--Adjusting entry:

December 31, 20A--Adjusting entry:

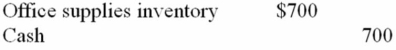

C. Lucky Company purchased office supplies during the year that cost $700 and placed the supplies in a storeroom for use as needed. The purchase was recorded as follows:

February 1, 20A:

At the end of 20A, a count showed unused office supplies of $200 in the storeroom. There was no beginning inventory of supplies on hand.

At the end of 20A, a count showed unused office supplies of $200 in the storeroom. There was no beginning inventory of supplies on hand.

December 31, 20A--Adjusting entry:

D. On December 31, 20A, Lucky Company owed employees $3,000 for wages earned during December. These wages had not been paid nor recorded.

December 31, 20A--Adjusting entry:

Correct Answer:

Verified

Q82: A trial balance is a list of

Q105: The statement of cash flows is designed

Q105: The dividends declared account should be closed

Q106: The comparative statements of financial positions of

Q107: Allen Corporation is completing the accounting information

Q109: Atlantic Company is completing the information processing

Q111: A. Explain how the income statement relates

Q112: Modern Woman magazine has received cash subscriptions

Q113: Below are two related transactions for Tweet

Q156: One part of an adjusting entry is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents