Below are four transactions that were completed during 20A by Doby Company. The annual accounting period ends on December 31. Each transaction will require an adjusting entry at Decembe 31, 20A. You are to provide the 20A adjusting entries required for Doby Company.

A. On July 1, 20A, Doby Company paid a two-year insurance premium for a policy on its equipment This transaction was recorded as follows:

July 1, 20A:

December 31, 20A--Adjusting entry:

December 31, 20A--Adjusting entry:

B. On December 31, 20A a tenant renting some office space from Doby Company had not paid the rent of $500 for December.

December 31, 20A--Adjusting entry:

C. On September 1, 20A, Doby Company borrowed $3,000 cash and gave a one-year, 10 percent, note payable. The total interest of $300 is payable on the due date, August 31, 20B. The note was recorded as follows:

September 1, 20A: Cash $3,000

Note payable $3,000

December 31, 20A--Adjusting entry:

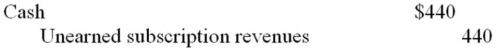

D. Assume Doby Company publishes a magazine. On October 1, 20A, the company collected $440 for subscriptions two years in advance. The $440 collection was recorded as follows:

October 1, 20A:

December 31, 20A--Adjusting entry:

December 31, 20A--Adjusting entry:

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q119: Settler Service is completing the information processing

Q120: Prepare adjusting entries for the following transactions.

1.

Q121: Model Company keeps a small inventory of

Q122: On December 31, 20X, Martin Company prepared

Q123: Is the adjusted trial balance a financial

Q126: Four transactions are given below that were

Q127: The following trial balance of Lazy Corporation

Q128: At December 31, 20A, the following adjusting

Q129: On December 1, 20A, Pest Company collected

Q148: Prepare adjusting entries for the following transactions.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents