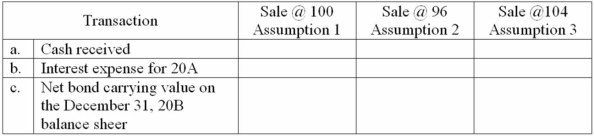

On June 30, 20A, Reagan Corporation sold (issued) a $1,000, ten-year, 8% bonds payable (interest payable each June 30 and December 31).

For the three assumptions below, complete the following schedule assuming the accounting year end December 31, and straight-line depreciation is used:

Correct Answer:

Verified

Q146: On April 1, 20B, Larel Corporation issued

Q147: Lamar Company authorized a $500,000, five-year, 12%

Q148: The following table values are provided for

Q149: Webber Company reported the following information for

Q150: Goodgold Corporation purchased a machine which had

Q151: Roy Company sold the following ten-year bonds

Q153: On January 1, 20A, Bodner Company agreed

Q154: Bush Company authorized $150,000 of 5-year bonds

Q155: The following information was taken from the

Q156: Austin Corporation sold its $1,000,000, 7%, ten-year

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents